Navigate Foreign Currency Exchange: Your Guide to the Best Rates & Avoiding Hidden Fees

Navigating foreign currency exchange effectively involves understanding exchange rates, comparing fees across different platforms, and utilizing strategies like credit cards with no foreign transaction fees to minimize costs and maximize value while traveling.

Traveling abroad is an exciting experience, but managing your money in a foreign country can be challenging. This guide will help you navigate foreign currency exchange, avoid hidden fees, and secure the best possible rates, ensuring your trip remains budget-friendly and enjoyable.

Understanding Foreign Currency Exchange Rates

Understanding foreign currency exchange rates is crucial for smart travel planning. Exchange rates fluctuate constantly due to various economic factors, so it’s essential to stay informed and know how these rates can affect your spending power.

What Influences Exchange Rates?

Several factors influence exchange rates, including economic indicators, political stability, and market speculation. Being aware of these elements can help you anticipate rate changes and plan your currency exchange accordingly.

Fixed vs. Floating Exchange Rates

Some countries use fixed exchange rates, where their currency’s value is pegged to another currency or commodity. Others use floating exchange rates, where the value is determined by market forces. Understanding which system a country uses can influence how you approach currency exchange.

- Economic Indicators: Inflation, interest rates, and trade balances all play a role in determining exchange rates.

- Political Stability: Countries with stable political environments tend to have more stable currencies.

- Market Speculation: Anticipation of future economic conditions can drive currency values up or down.

Keeping these factors in mind will better equip you to anticipate shifts in exchange rates and make informed decisions about when and where to exchange your currency. Staying informed is key to getting the most for your money when traveling internationally.

Where to Exchange Currency: Weighing Your Options

Choosing the right place to exchange currency is essential for minimizing fees and maximizing your exchange rate. Various options are available, each with its own set of pros and cons.

Banks and Credit Unions

Banks and credit unions often offer competitive exchange rates and lower fees, especially if you’re already a customer. They also provide a secure environment for transactions.

Currency Exchange Bureaus

Currency exchange bureaus, such as those found in airports and tourist areas, can be convenient but often charge higher fees and offer less favorable exchange rates.

ATMs

Using ATMs to withdraw local currency can be a convenient option, but be mindful of potential fees from both your bank and the ATM operator. It’s often better to use ATMs that are part of a larger banking network to reduce fees.

- Convenience vs. Cost: Weigh the convenience of exchanging currency at airports against the higher fees.

- Research Local Banks: Look for local banks or credit unions that offer better rates and lower fees.

- Check ATM Fees: Inquire about ATM fees from your bank and the local ATM operator to avoid surprises.

By evaluating these options carefully, you can make an informed decision about where to exchange your currency. Prioritize security, transparency, and competitive rates to ensure you get the best value for your money.

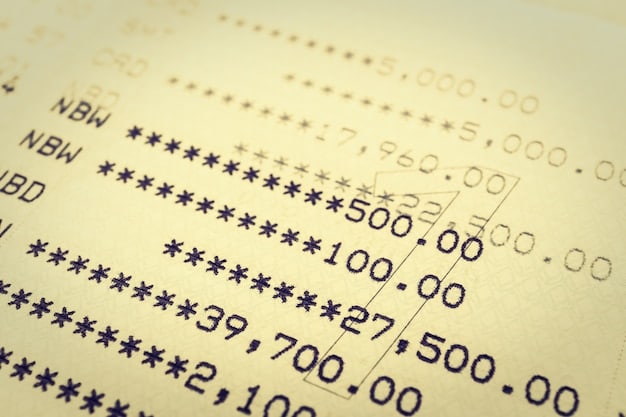

Decoding Hidden Fees in Foreign Currency Exchange

Hidden fees can significantly eat into your travel budget if you’re not careful. Understanding and avoiding these fees is crucial to making the most of your money while abroad.

Transaction Fees

Transaction fees can be charged by banks, credit unions, and currency exchange bureaus for processing your exchange. These fees can vary widely, so it’s important to compare them.

Service Charges

Service charges are sometimes added on top of transaction fees, particularly by currency exchange bureaus. Always inquire about all potential charges before proceeding with the exchange.

Exchange Rate Markups

Exchange rate markups occur when the exchange rate offered is less favorable than the actual market rate. This is a common way for exchange services to make a profit, so be sure to compare rates.

- Always Ask About Fees: Never hesitate to ask about all potential fees and charges before exchanging currency.

- Compare Exchange Rates: Use online tools and resources to compare exchange rates and find the best deals.

- Read the Fine Print: Take the time to read the fine print and understand all the terms and conditions of the exchange.

Being proactive about understanding and questioning fees can save you a considerable amount of money. Knowledge is your best defense against hidden costs in foreign currency exchange.

Credit Cards: A Smart Alternative for International Travel

Using credit cards can be a convenient and cost-effective way to manage your finances while traveling internationally. However, it’s important to choose the right card and understand the associated fees.

Credit Cards with No Foreign Transaction Fees

Many credit cards offer no foreign transaction fees, making them an excellent choice for international travel. These cards allow you to make purchases without incurring extra charges for each transaction.

Rewards and Benefits

Some credit cards offer rewards and benefits such as travel insurance, rental car coverage, and purchase protection. These perks can add significant value to your travel experience.

Using Credit Cards Wisely

To maximize the benefits of using credit cards while traveling, pay your balance in full each month to avoid interest charges and be mindful of your spending to stay within your budget.

Choosing a credit card with no foreign transaction fees and a good rewards program can save you money and provide added peace of mind while traveling abroad. Understanding the terms and conditions is essential to avoid unexpected costs.

Leveraging Technology: Apps and Online Platforms for Better Rates

Technology offers several tools and platforms that can help you find the best foreign currency exchange rates and minimize fees. Mobile apps and online services have revolutionized how travelers manage their money.

Currency Converter Apps

Currency converter apps allow you to quickly and easily calculate exchange rates. These apps provide real-time information, helping you make informed decisions about when to exchange currency.

Online Currency Exchange Platforms

Online currency exchange platforms often offer more competitive rates than traditional banks and exchange bureaus. These platforms allow you to exchange currency online and have it delivered to your home or picked up at a local branch.

Peer-to-Peer Exchange Services

Peer-to-peer exchange services connect individuals who want to exchange currency with each other. This can be a cost-effective way to get better rates, but be sure to use reputable platforms with security measures in place.

- Real-Time Updates: Use currency converter apps to stay informed about real-time exchange rate fluctuations.

- Secure Platforms: Choose reputable online platforms with strong security measures to protect your transactions.

- Compare Rates: Always compare rates across different platforms to ensure you’re getting the best deal.

By leveraging technology, you can take control of your foreign currency exchange and find the most cost-effective solutions. Staying informed and using the right tools can save you money and simplify your travel finances.

Planning Ahead: Timing Your Currency Exchange for Optimal Value

Timing is crucial when it comes to foreign currency exchange. Planning ahead and monitoring exchange rates can help you secure the best possible value for your money.

Monitoring Exchange Rate Trends

Keep an eye on exchange rate trends in the weeks and months leading up to your trip. This will give you a sense of when rates are most favorable and allow you to plan your exchange accordingly.

Exchanging Currency Before You Leave

Exchanging currency before you leave can save you time and stress upon arrival. It also allows you to lock in a favorable exchange rate if you find one.

Avoiding Last-Minute Exchanges

Avoid exchanging currency at the last minute, especially at airports and tourist areas, where rates are typically less favorable. Plan ahead and exchange currency in advance to get the best deals.

- Set Rate Alerts: Use online tools to set up alerts that notify you when exchange rates reach a certain level.

- Exchange in Advance: Exchange currency a few weeks before your trip to avoid last-minute stress.

- Be Patient: Don’t rush into exchanging currency if rates are unfavorable. Wait for a better opportunity to get more for your money.

By planning ahead and timing your currency exchange effectively, you can maximize your buying power and make your travel budget go further. Staying informed and being patient are key to securing optimal value.

| Key Point | Brief Description |

|---|---|

| 💡 Exchange Rate Awareness | Monitor rates for the best value. |

| 💳 Credit Cards | Use cards with no foreign transaction fees. |

| 📱 Tech Tools | Utilize apps for rate conversions. |

| 🏦 Choose Wisely | Compare banks and exchange bureaus. |

FAQ

The best time is when the exchange rate is favorable. Monitor trends and exchange a few weeks before your trip to secure a good rate and avoid last-minute stress.

Credit cards with no foreign transaction fees can be better due to convenience and security. They also often offer rewards and benefits like travel insurance and purchase protection.

Always ask about all potential fees before exchanging currency. Compare rates across different platforms and read the fine print to understand all terms and conditions.

Popular apps for tracking exchange rates include XE Currency Converter, Google Currency Converter, and other banking apps that offer real-time exchange rate updates.

It’s generally better to exchange currency at your bank, as airports often have higher fees and less favorable exchange rates. Banks typically offer more competitive rates.

Conclusion

Effectively navigating foreign currency exchange involves careful planning, awareness of fees, and leveraging technology to your advantage. By understanding exchange rates, choosing the right payment methods, and staying informed, you can minimize costs and maximize your travel budget, ensuring a smoother and more enjoyable international experience.